Account SwitchKit

The complex process of transferring an existing bank account to another institution poses financial and security risks and affects the end-user experience by utilizing manual methods that are time-consuming and error-prone

With our Account SwitchKit product, you can offer your end-users to seamlessly switch their payment accounts through real-time access using Open Banking financial data, ensuring a fast and secure customer transition.

Our Portfolio Account Switch product allows your end-users to switch their portfolio account including all their securities such as shares, funds, etc., to you by leveraging our extensive network of connected financial providers.

Account SwitchKit simplifies and digitizes the entire process, reducing costs and labor while ensuring a streamlined end-user experience. It is a fully digital product that enables end-users to transfer their bank accounts from one bank to another within minutes, including notifying all payment partners about the new account.

From a user’s perspective, our Account SwitchKit enables a rapid and secure account switch in under 10 minutes, without requiring them to exit the bank's application

How it works

Your end-user initiates the account switch process on your website and is then redirected to a fully white-labeled landing page to begin the onboarding flow using our service.

The user selects their old bank and is guided through an account connection process utilizing our in-house financial data product, along with our data categorization and enrichment service. This process divides the account transactions into categories (direct debit, incoming payment, standing order) and identifies the user's payment partners.

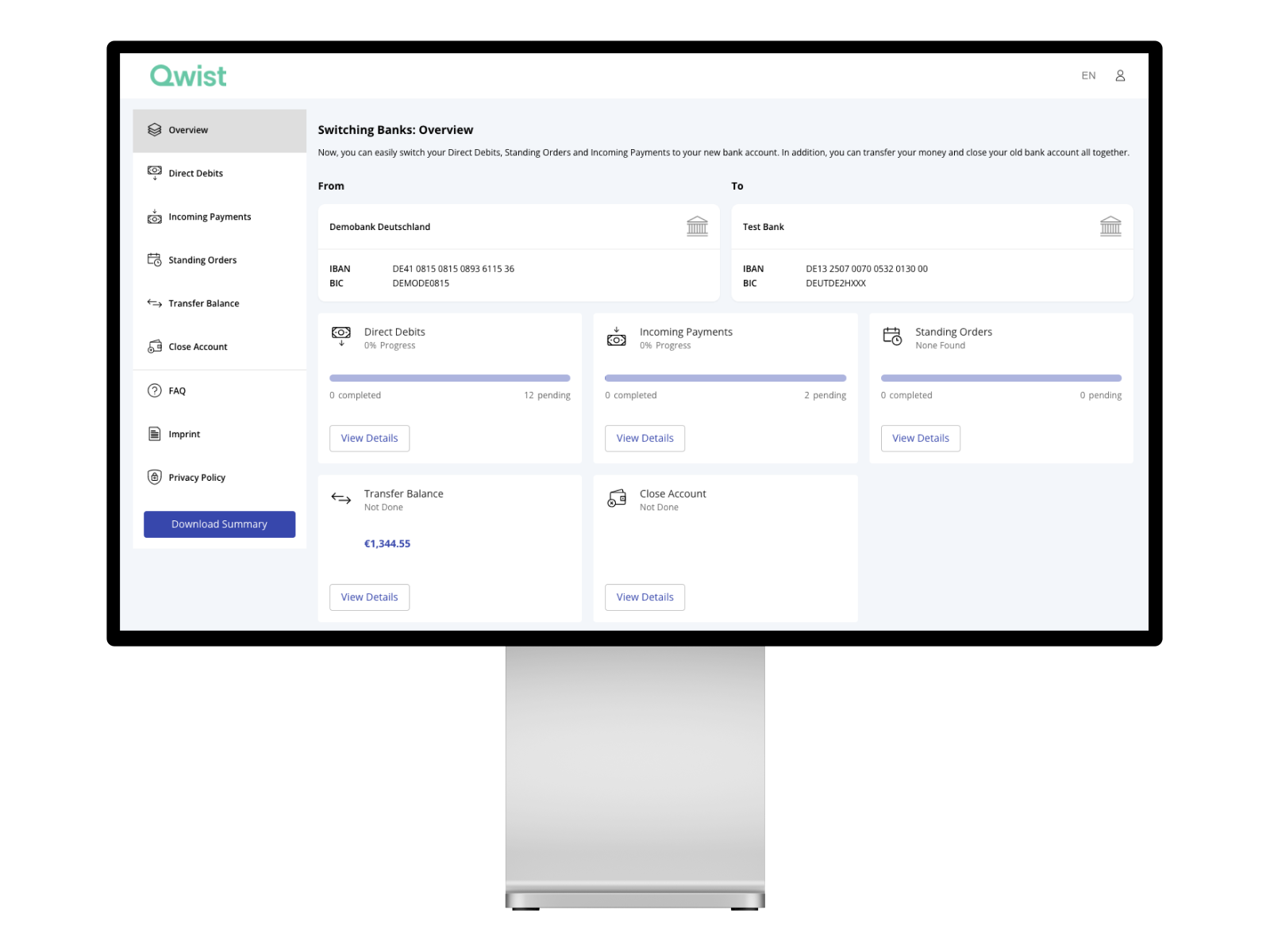

Once everything is set up, the end-user arrives at a dedicated dashboard, where they can navigate through various tabs to perform the following actions and send notifications to payment partners:

-Inform them about the switch

-Transfer the account balance

-Close the old bank account

When the end-user completes any of these actions, we engage one of our third-party providers to send notifications to the payment partner, informing them about the account switch.

Demo Account SwitchKit

You want to learn what the process and the user flow will look like? Get in touch!